Leasing Electronics: Cut Costs & Upgrade Tech

Patricia Bernal

Apr 4, 2025

The Evolving Landscape of Leasing Electronics

The electronics leasing market is undergoing a significant transformation. Economic pressures and the rapid pace of technological advancement are encouraging both businesses and consumers to embrace leasing models. This marks a departure from traditional ownership and a move towards more flexible access to technology. These changes have profound implications for how we acquire and interact with electronics.

Why Leasing is Gaining Traction

A primary driver of this trend is the ever-increasing speed of technological obsolescence. New devices and software updates are constantly emerging, making it challenging and costly for individuals and companies to keep up. Leasing provides a solution by enabling users to upgrade their devices regularly without the substantial upfront costs associated with purchasing. This ensures access to cutting-edge technology without the concern of devices quickly becoming outdated.

Leasing electronics also offers significant cost savings. Instead of a large initial investment, leasing allows for smaller, predictable monthly payments. This is particularly appealing to businesses aiming to manage cash flow and avoid large capital expenditures. For consumers, leasing makes premium technology more attainable. Electronics rental: The smart choice for businesses and consumers in 2025 offers further insight.

The global electronics product rental market is experiencing robust growth. Projections forecast a market size of $21,677 million in 2025, expanding to $41,022.9 million by 2033. This growth is fueled by technological progress and changing consumer preferences. You can explore more detailed statistics here. This substantial expansion underscores the rising acceptance of leasing as a practical alternative for acquiring electronics.

The Shift in Consumer Mindset

The move toward leasing reflects a fundamental shift in consumer attitudes towards ownership. Younger generations are less focused on owning physical goods and more receptive to subscription-based services. Access to the latest technology and the flexibility to upgrade regularly often outweigh the desire for outright ownership. This evolving mindset is reshaping the consumer electronics landscape.

This change is apparent across various sectors. Corporate adoption of electronics leasing has been rapid, while other industries are adapting more gradually. The overall trend, however, points to a growing recognition of leasing's advantages, especially in managing tech budgets and accessing the latest innovations. These compelling benefits suggest the continued growth of this trend in how we acquire and use electronics.

Business Transformation Through Leasing Electronics

Leasing electronics offers businesses much more than simply cutting costs; it's fundamentally changing how they operate. Companies that are looking ahead are using electronics leasing as a way to gain a competitive advantage in the rapidly evolving world of technology. Let's explore how leasing can transform a business, helping it not just adapt but truly thrive.

Enhancing Cash Flow and Financial Flexibility

One of the biggest advantages of leasing electronics is the positive impact it has on cash flow. Rather than locking up significant amounts of capital in purchasing equipment outright, businesses can access the latest technology with predictable monthly payments. This frees up valuable resources that can be invested in other key areas like research and development, marketing initiatives, or expansion projects.

Leasing also provides budgetary predictability, as payments remain consistent throughout the lease term. This makes financial planning a much smoother process. With predictable expenses, businesses can make smarter decisions about future spending and strategically allocate resources.

Overcoming Obsolescence and Embracing Innovation

Technology advances so rapidly that obsolescence is an ongoing concern. Leasing electronics offers a practical solution by allowing businesses to upgrade regularly. This ensures they always have access to cutting-edge technology, maximizing productivity and efficiency.

For example, employees equipped with the newest laptops and software can work more effectively. This can lead to increased output and higher revenue. By constantly having access to innovative technology, businesses remain competitive and agile, ready to respond to market changes.

Historically, leasing has proven a cost-effective approach, especially within the telecommunications industry. In the late 1970s, companies like MCI adopted switched network services to compete with AT&T's leased lines. This demand for more flexible communication systems highlighted the changing role of electronics leasing. For more information, explore this historical perspective: Switched Network Services. This historical context underscores the long-term importance of adaptability within the electronics leasing landscape.

Optimizing Technology Lifecycle Management

Leasing electronics simplifies technology lifecycle management, creating predictable refresh cycles for smoother upgrades. This eliminates the hassles and disruptions of disposing of old equipment and acquiring new devices.

Leasing companies often manage the entire lifecycle, including delivery, setup, end-of-lease removal, and even recycling. This comprehensive service further reduces the administrative workload for businesses, allowing them to concentrate on core operations.

Realizing Productivity Gains and Employee Satisfaction

Giving employees access to modern technology through leasing can significantly improve productivity. Advanced tools streamline workflows and enhance efficiency. Furthermore, providing updated equipment increases employee morale and job satisfaction.

A positive work environment can lower employee turnover and attract talented professionals, contributing to better overall business performance. This cultivates a more positive and productive company culture.

Industry-Specific Applications and Benefits

The benefits of leasing electronics are seen across various industries. Healthcare providers, for instance, can lease expensive medical equipment without a major capital outlay. Educational institutions can equip students with the latest technology, enhancing learning experiences. These are just a few examples of how leasing enables organizations to access essential equipment while managing finances responsibly.

You can find more valuable insights into the advantages of leasing in this helpful resource: How B2B Leasing Can Boost Profits and Efficiency. Ultimately, leasing electronics offers a strategic path for businesses to flourish in today’s evolving technological environment. By maximizing cash flow, embracing innovation, and boosting employee productivity, organizations can sharpen their competitive edge and achieve lasting success. This strategic approach to acquiring technology allows businesses to concentrate on growth and development.

Consumer Revolution in Leasing Electronics

The consumer relationship with electronics is changing. Instead of outright ownership, leasing electronics is gaining traction. This shift is driven by a combination of psychological factors, financial considerations, and evolving consumer behaviors. Let's explore the reasons behind this growing trend and what it means for the future of personal technology.

The Psychology of Access Over Ownership

A key driver of electronics leasing is the changing view of ownership. For many, particularly younger generations, having access to the latest technology is more important than owning it. This aligns with the rising popularity of subscription services and the demand for flexibility and convenience. Consumers are prioritizing the experience and functionality a device offers over traditional ownership.

Additionally, environmental awareness is a factor. Leasing can be a more sustainable approach to electronics consumption. Leasing companies often handle responsible disposal and recycling of devices, which is appealing to environmentally conscious consumers. This resonates with the growing awareness of sustainability and the desire to reduce the environmental impact of technology.

Financial Flexibility and Affordability

Leasing electronics offers financial flexibility that traditional purchases often lack. Rather than one large upfront payment, consumers make smaller, manageable monthly payments. This makes high-end devices, such as premium smartphones and laptops, accessible to more people. For example, someone might not be able to afford a $1,500 laptop upfront but could comfortably afford a $50 monthly lease payment. This democratizes access to advanced technology and allows consumers to enjoy the latest innovations without significant initial costs.

Leasing also eliminates the concern of depreciation. Consumers can upgrade to newer models at the end of their lease without the need to resell or trade in their old devices. This avoids the frustration of owning outdated electronics and ensures continuous access to cutting-edge technology.

In the United States, the Consumer Electronics & Appliances Rental industry has shown consistent growth. Between 2020 and 2025, the industry expanded at a CAGR of 1.4%, reaching a market size of approximately $9.8 billion in 2025. This growth is due to shorter appliance lifespans and rising repair costs, making leasing increasingly appealing. More detailed statistics can be found here. This further supports the increasing acceptance of leasing as a viable option.

Subscription Fatigue and Electronics Leasing

While “subscription fatigue” has affected some industries, its impact on electronics leasing has been minimal. This is likely because essential electronics, like smartphones and laptops, are seen differently than other subscription services. These devices are often vital for daily life and work, making the recurring cost more justifiable.

Reshaping Leasing Terms and Consumer Expectations

Consumer expectations are shaping the future of electronics leasing. Demands for shorter lease terms, flexible upgrade options, and comprehensive warranty coverage are becoming more common. Leasing companies are adapting to these demands to stay competitive. This demonstrates a consumer-driven market where providers must respond to changing preferences and offer personalized solutions.

The Future of Personal Technology Acquisition

The rise of electronics leasing suggests a significant shift in how consumers acquire and use technology. The accessibility, financial flexibility, and continuous access to innovation offered by leasing will likely propel this trend across various income levels and lifestyles. This could fundamentally change the consumer electronics market, with leasing potentially becoming the preferred method for acquiring personal technology.

Global Variations in Leasing Electronics Markets

The electronics leasing market presents a diverse global landscape. Regional differences create both challenges and exciting prospects for businesses. These variations stem from a combination of cultural norms, government policies, and economic realities. Understanding these local nuances is crucial for success in the international leasing arena.

Cultural Attitudes and Leasing Preferences

Cultural perspectives on ownership play a significant role in how consumers view electronics leasing. In some societies, owning electronics is a sign of status. In others, practicality and access are more important. Cultures that value experiences over possessions might be more receptive to leasing. This cultural context should inform marketing and leasing strategies.

Subscription models also see varying levels of acceptance across different cultures. This can influence how consumers perceive electronics leasing. Adapting to these cultural differences is vital for effective market entry.

Regulatory Environments and Leasing Practices

Legal frameworks surrounding leasing differ significantly from country to country. Regulations on contracts, consumer protection, and data privacy all impact the viability of leasing operations. Some countries impose strict requirements for lease agreements, affecting the ease of conducting business. Complying with local laws is essential for operational success.

Tax regulations and incentives also shape the leasing market. Favorable tax policies can boost market growth, while unfavorable ones can hinder it. This complexity adds another layer to navigating the global leasing landscape.

In 2024, the Consumer Electronics & Appliances Rental market reached a global value of approximately $26.7 billion. Regionally, the Americas accounted for $11.7 billion, Asia & Oceania $7.4 billion, and Europe $6.6 billion. This includes consumer electronics, appliances, and rent-to-own services. For more details on this market, see Kentley Insights. This data underscores the substantial economic activity generated by electronics leasing worldwide.

Economic Conditions and Leasing Adoption

Economic factors, like income levels and credit access, influence leasing adoption rates. In regions with lower disposable income, leasing makes high-priced electronics more attainable. In wealthier areas, consumers might prefer outright purchases.

The availability of financing also affects consumer choices. Easy access to traditional financing could make leasing less attractive. However, in markets with limited credit access, leasing becomes a valuable alternative. These economic factors interact with consumer behavior to shape regional leasing trends.

Navigating Global Market Differences

For businesses involved in international electronics leasing, adapting to regional differences is paramount. This means understanding local consumer preferences, complying with varying regulations, and tailoring pricing and marketing strategies. Thorough market research, collaborations with local partners, and culturally sensitive messaging are often necessary. This adaptability is the key to successful global market entry and operation.

To help illustrate the different leasing options available, let's take a look at a comparison table. This table breaks down the pros and cons of each approach for both consumers and businesses.

Comparing Electronics Leasing Options

Leasing Type | Best For | Typical Duration | Cost Structure | Advantages | Limitations |

|---|---|---|---|---|---|

Operating Lease | Businesses needing short-term access | 1-3 years | Monthly payments | Lower upfront costs, flexibility to upgrade | No ownership at end of lease, potential higher total cost |

Finance Lease | Businesses intending to own the equipment | 3-5 years | Fixed monthly payments | Option to purchase at end of lease, tax benefits | Higher monthly payments, responsibility for maintenance |

Consumer Lease | Individuals wanting access to latest electronics | 1-2 years | Monthly payments | Lower upfront cost, access to new technology | No ownership at end of lease, potential fees for early termination |

Rent-to-Own | Individuals with poor credit wanting to own eventually | Variable, often longer term | Higher monthly payments | Ownership at end of lease, no credit check required | Significantly higher total cost, potential for repossession |

This table highlights the diverse options available in the electronics leasing market. Each approach caters to different needs and circumstances. Understanding the distinctions between these options is essential for making informed decisions.

Local Dynamics in Leasing Electronics Markets

While global leasing trends often dominate headlines, true innovation frequently bubbles up from local markets. Smaller, regional players are developing unique value propositions that often outshine those of larger, national corporations. By focusing on these local providers, we can glean valuable insights into customer relationships and uncover profitable niche opportunities.

The Power of Community Connections

Local electronics leasing businesses often cultivate deep relationships within their communities. This fosters trust and loyalty, leading to higher customer retention rates, often exceeding national averages. This personalized customer service creates a competitive edge that larger, less nimble companies struggle to match.

These close community ties also generate valuable word-of-mouth referrals, a powerful driver of business growth. Local businesses can leverage these connections to build a strong and loyal customer base.

Niche Markets and Specialized Services

Local leasing providers often thrive by specializing in niche markets. This targeted approach allows them to cater to specific customer needs and develop highly relevant solutions. For instance, a local provider might focus on short-term leases for businesses with seasonal needs or project-based work.

This specialization cultivates deep expertise and strengthens customer relationships. It also opens the door to higher profit margins, a key benefit for smaller businesses.

Navigating Regional Economic Factors

Regional economies significantly influence how leasing businesses operate. In Minnesota, for example, the Consumer Electronics & Appliances Rental industry has a market size of approximately $2.2 million. This smaller market reflects broader trends in electronics leasing, such as the increasing reliance on omnichannel strategies. Learn more about this specific market here.

Understanding regional economic conditions allows leasing companies to tailor their strategies to local market dynamics and customer needs. This adaptability is essential for success in a fluctuating market.

Thriving Despite Resource Constraints

Smaller leasing providers often operate with limited resources. However, they consistently overcome these challenges with creative strategies. They might partner with local businesses for broader reach or utilize digital marketing for efficient customer engagement.

This resourcefulness enables them to compete effectively, even with smaller budgets. This adaptability is vital for navigating the ever-changing electronics leasing landscape.

Lessons from Local Success Stories

Larger companies can learn valuable lessons by studying the successes of local electronics leasing businesses. Key takeaways include the importance of cultivating strong customer relationships, identifying lucrative niche markets, and adapting strategies to regional economic factors.

These insights provide valuable guidance for any business involved in leasing electronics. Understanding the nuances of local markets allows companies to better position themselves for growth and innovation.

Crafting Your Ideal Leasing Electronics Strategy

Leasing electronics offers a practical solution for businesses seeking to access the latest technology without the burden of hefty upfront investments. However, navigating the leasing landscape requires a strategic approach to maximize benefits and avoid potential downsides. A well-defined strategy involves carefully vetting providers, understanding contract nuances, and planning for the future.

Evaluating Leasing Providers

When choosing a leasing provider, don't solely fixate on the monthly payment. Consider crucial factors like the provider's reputation for customer service, the quality of their equipment, and the support they offer. A slightly higher monthly fee might be worthwhile if it comes with superior service and reliable technology.

Also, examine the provider's upgrade policy. Flexible upgrade options are essential for staying current with technological advancements. This empowers you to access newer models without being tied to outdated equipment.

Understanding Contract Terms

Before signing any lease agreement, thoroughly review the terms and conditions. Pay particular attention to critical details such as the lease duration, early termination fees, and responsibilities for maintenance.

A longer lease might offer lower monthly payments, but it restricts your ability to upgrade. Conversely, a shorter lease provides greater flexibility but might involve higher monthly costs. Some leases require you to handle all maintenance, while others include it in the agreement. For more information on leasing advantages and challenges, see this helpful resource: Renting Issues in Business and Their Solutions - Advantages of Leasing. Understanding these details empowers you to make informed choices and avoid unforeseen costs.

Calculating the True Cost

For accurate comparisons between leasing options, calculate the total cost of ownership across the entire lease period. Factor in all fees, including delivery charges, setup fees, and potential end-of-lease expenses. This comprehensive calculation provides a more precise comparison than merely looking at monthly payments.

Don't forget the potential tax implications. Leasing payments can be tax-deductible for businesses, which can significantly influence the overall cost.

Negotiating Favorable Terms

Don't hesitate to negotiate with leasing providers. Many are open to adjusting terms, particularly for long-term leases or bulk orders. Negotiating points can include lower monthly payments, waived fees, or increased flexibility for upgrades. You could, for instance, negotiate a lower monthly payment in exchange for a longer lease term.

Planning for End-of-Lease

Before signing the lease, think about your end-of-lease options. Will you be able to purchase the equipment, return it, or upgrade to a newer model? Understanding your options upfront avoids unexpected costs and ensures a seamless transition at the lease's conclusion.

Building Flexibility Into Your Agreements

Whenever possible, incorporate flexibility clauses into your lease agreement. Options such as early upgrade provisions or the ability to modify the lease term can be crucial if your business needs change. If your business expands rapidly, you might need to upgrade equipment sooner than planned. Including these options in your lease protects you from unexpected circumstances.

The Future Landscape of Leasing Electronics

The electronics leasing industry is poised for significant transformation. Emerging technologies and shifting market dynamics are reshaping how we access and use electronic devices. This evolution presents both opportunities and challenges for consumers and businesses alike.

The Rise of AI and IoT Integration

Artificial intelligence (AI) and the Internet of Things (IoT) are revolutionizing leasing models. AI allows for more personalized leasing agreements, predicting user needs, and optimizing device usage.

For example, AI algorithms can analyze usage patterns to recommend the most appropriate devices and lease terms for individual consumers or businesses. This personalized approach improves customer satisfaction and streamlines the leasing process.

Furthermore, IoT integration connects leased devices, providing real-time performance data and predictive maintenance capabilities. This interconnectedness minimizes downtime and extends the lifespan of electronics, enhancing the overall value of leasing.

This proactive maintenance approach results in cost savings and improved operational efficiency for businesses.

The Circular Economy and Sustainability

Growing emphasis on sustainability is reshaping the practices of electronics leasing providers. The circular economy model, prioritizing reuse and recycling, is gaining momentum.

Leasing companies are implementing more robust end-of-lease procedures for device refurbishment and responsible recycling. This aligns with consumer values and promotes responsible resource management.

This shift toward a circular economy also creates new business opportunities. Leasing providers can monetize second-hand markets and participate in the growing refurbishment sector. This benefits their bottom line while contributing to a more sustainable approach to electronics consumption.

The Convergence of Subscription Services

The lines between leasing and subscription services are becoming increasingly blurred. We're witnessing a rise in "as-a-service" models for electronics, where users subscribe to a bundle of hardware, software, and support for a recurring fee.

This provides businesses with predictable technology costs and access to the latest updates. This trend is transforming how businesses acquire and manage technology, offering a simplified and cost-effective solution.

This convergence simplifies budgeting and streamlines technology management. Businesses benefit from a reduced administrative burden and increased financial predictability, allowing them to concentrate on their core operations.

Changing Work Patterns and Device Preferences

Evolving work patterns are influencing device choices. The rise of remote and hybrid work models has increased demand for portable and versatile devices. Leasing offers a way to access these devices without significant capital investment, accommodating the dynamic needs of the modern workforce.

Leasing providers are responding by offering a broader range of devices and lease terms to meet the diverse needs of businesses and individual consumers. This flexibility is essential for remaining competitive in a constantly evolving market.

Positioning Yourself in the Evolving Ecosystem

The future of electronics leasing is defined by flexibility, personalization, and sustainability. To thrive in this ecosystem, both consumers and businesses must stay informed about emerging trends.

This includes carefully evaluating lease agreements, considering the total cost of ownership, and focusing on long-term value. By understanding these factors, individuals and businesses can optimize their technology acquisition strategies and maximize their return on investment.

Businesses must develop flexible technology strategies aligned with changing workplace dynamics. This requires understanding employee needs and choosing leasing partners that offer adaptable solutions. Staying informed about the latest technological advancements and market trends is crucial for making informed decisions.

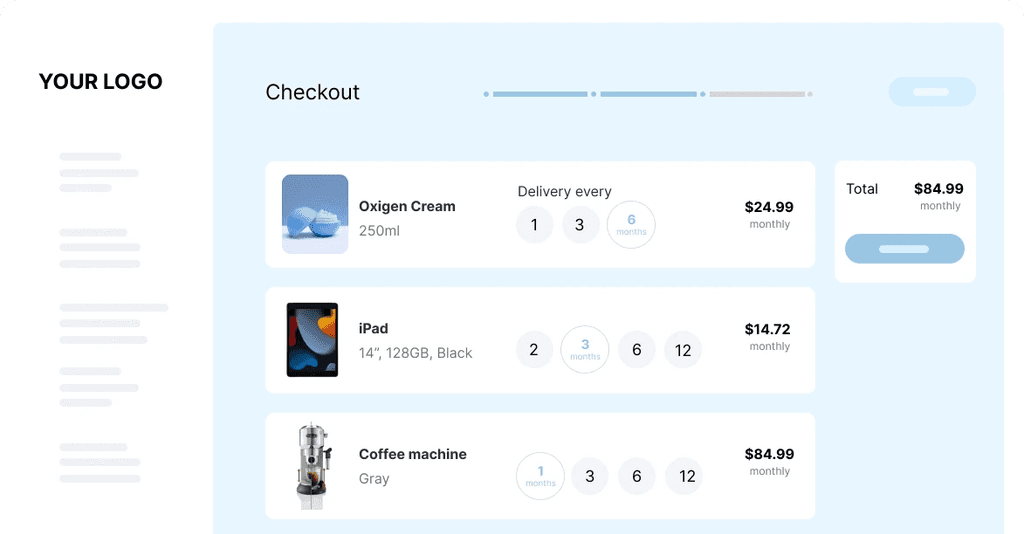

Sharpei offers businesses the flexibility to offer their customers various payment options, including leasing, at checkout. Explore how Sharpei can help your business adapt to the evolving landscape of electronics consumption. This innovative payment solution empowers businesses to embrace change and provide customers with the flexibility they need.

Related posts

Ready To Join The Circular Movement?

United for a smarter shopping experience and a better planet