Unlocking the 7 Key Lease to Own Benefits

Patricia Bernal

Feb 20, 2025

Is Lease-to-Own Right for You?

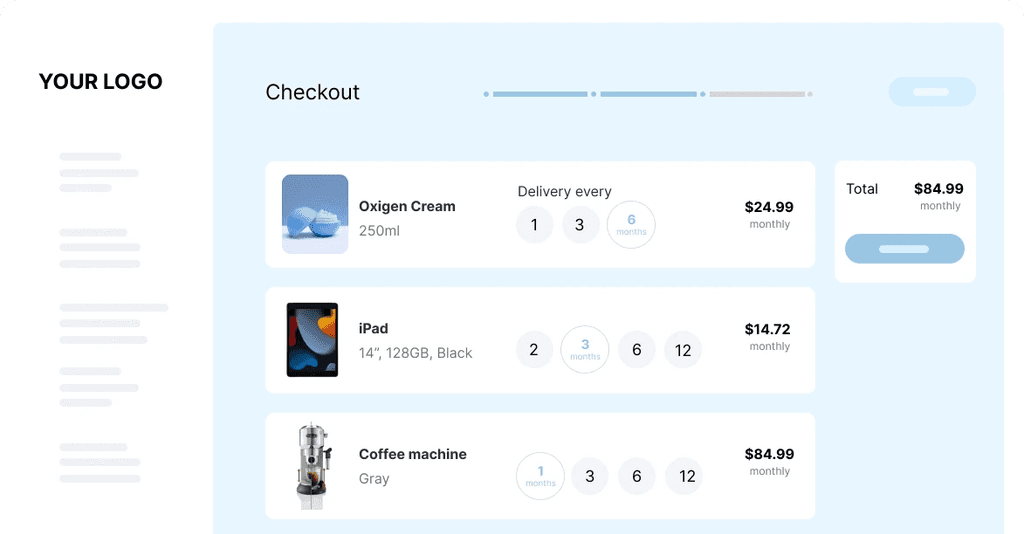

As customer preferences evolve, retailers are adopting new payment models both online and in stores. One option gaining traction is lease-to-own, which allows customers to use products while making payments toward ownership. But is this the right choice for your business? Let's explore the mechanics of lease-to-own and the factors to consider.

Lease-to-own started as a way to help customers acquire items they want without paying the full price upfront. Initially focused on real estate, it now includes furniture, appliances, and electronics. A successful lease-to-own program benefits both the customer and business by offering flexibility while safeguarding profitability. Key aspects include strategic pricing, transparent contract terms, and reliable customer service.

This guide will cover 7 key benefits of incorporating lease-to-own options into your business:

Increased sales and revenue

Enhanced customer relationships

Access to new customer demographics

Competitive edge

More payment options

Inventory management advantages

Long-term customer loyalty

We'll delve into each benefit to help you determine if lease-to-own aligns with your business objectives and customer needs. Understanding the opportunities and challenges will allow you to make an informed decision about this payment model.

1. Try Before You Commit

One of the primary benefits of lease-to-own for technology or machinery is the ability to test the product before committing to a purchase. Similar to test-driving a car, lease-to-own lets businesses use the equipment extensively before making a final purchase decision. This reduces uncertainty and allows for a thorough evaluation.

Why It Matters

During the lease period, you have full access to use the product under real-world conditions. This period serves as an extended trial, allowing you to identify any issues and confirm that the equipment meets your business needs. This is especially beneficial for businesses relying heavily on specific technologies or machinery.

Features and Benefits:

Complete access: Use the equipment as you would if you owned it

Identify potential issues: Test the product in different scenarios to uncover any problems

Assess suitability: Evaluate how well the product integrates into your daily operations

Pros:

Hands-on experience: Gain a deep understanding of the product's capabilities

Identify issues early: Address problems before finalizing the purchase

Ensure compatibility: Confirm that the product meets your operational needs

Cons:

Higher lease costs: Expect to pay more than standard leasing fees

Maintenance duties: You may be responsible for certain upkeep tasks

Limited modifications: Major changes are usually not allowed during the lease period

Implementation Tips:

Professional inspection: Have an expert evaluate the equipment even during the trial

Clarify terms: Ensure the agreement outlines maintenance responsibilities and purchase details

Budget accordingly: Plan for increased lease payments

This try-before-you-buy approach is particularly valuable for businesses, providing critical time to assess and make informed decisions about equipment purchases.

2. Gradual Down Payment Accumulation

A significant challenge in acquiring high-value technology or machinery is the upfront down payment. Lease-to-own provides an alternative by allowing you to build that down payment incrementally. This makes large purchases more feasible for expanding businesses.

How it Works

Lease-to-own functions as a savings mechanism embedded in your regular payments. Each month, part of your payment is allocated toward the eventual purchase. This method helps instill good financial practices, supporting down payment goals even with fluctuating cash flows.

Features and Benefits

Credit toward purchase: Payments include an amount contributing to your future purchase

Savings structure: Regular payments create a clear path to ownership

Price security: Agreements often lock in the purchase price, shielding you from market fluctuations

Pros

Automated savings: Ideal for businesses struggling with consistent saving

Lower initial investment: Often requires less upfront cash than traditional financing

Improved financing terms: Larger down payments can lead to better interest rates

Cons

Higher monthly expenses: Payments will be more than standard leasing costs

Risk of lost funds: Incomplete purchases may lead to forfeited purchase credits

Capital allocation: Funds going toward purchase could be used elsewhere

Practical Tips for Implementation

Accurate calculations: Know exactly how much goes toward the purchase price

Separate savings records: Track purchase credits in a dedicated account

Document thoroughly: Keep detailed records of payments and credits

For many businesses, the lease-to-own model offers a practical route to ownership, bridging the gap between current resources and growth objectives.

3. Price Stability

Price protection in a lease-to-own agreement offers peace of mind, particularly in rapidly changing markets. This feature sets the purchase price at the start of the lease, protecting against market shifts. You’ll know the precise cost when the lease concludes.

How It Works

When entering a lease-to-own agreement, a fixed purchase price is established. This price remains unchanged regardless of market conditions, giving you the option to purchase at this pre-determined price when the lease ends.

Why It Matters

For businesses, price stability eliminates a major source of uncertainty. It allows you to secure crucial equipment at current prices, facilitating budgeting and planning, which is crucial for companies looking to expand their operations.

Pros and Cons:

Pros: Predictable future costs, potential equity gains if values rise

Cons: Fixed price if market drops, premium cost for stability, limited negotiation later

Practical Tips:

Market research: Understand trends before committing to ensure the price is reasonable

Long-term planning: Ensure the equipment aligns with your business plans

Cost analysis: Compare total costs, including any premiums, to other buying options

Price stability is a key benefit of lease-to-own agreements, offering businesses a way to manage expenses and make informed investments.

4. Credit Development Opportunity

Lease-to-own programs offer a valuable chance to build or improve credit. A strong credit score enables access to favorable financial terms and partnerships.

Features

Payment records: Each payment builds a formal record of financial reliability

Credit reporting: Many providers report to major credit bureaus

Financial responsibility: Consistent payments demonstrate creditworthiness

Pros:

Credit improvement: Timely payments can significantly boost your score

Better terms: Higher scores result in more favorable loan conditions

Payment proof: A solid payment history aids in securing future financing

Cons:

Not all providers report: Check if your payments will be reported

Late payments impact: Missing payments can harm your credit

Provider cooperation needed: The seller must agree to report payments

Businesses increasingly use lease-to-own to build credit, recognizing its importance in securing traditional loans. This option provides a practical way to acquire needed equipment while establishing positive credit.

Tips for Credit Maximization:

Verify reporting: Confirm if and where payments are reported

Automate payments: Set up automatic payments to avoid missed deadlines

Maintain records: Keep all payment confirmations and amounts

By following these strategies, businesses can effectively use lease-to-own to strengthen credit and support future growth.

5. Immediate Usage

Immediate usage is a significant advantage of lease-to-own agreements, allowing businesses to quickly access necessary technology or machinery. This is especially beneficial for rapidly expanding companies in need of equipment.

Benefits

Quick access: Avoid delays associated with traditional purchasing

No initial financing needed: Bypass large upfront expenses

Simplified qualification: Easier than qualifying for traditional loans

Main Advantages:

No interim solutions: Suitable for businesses needing immediate equipment

Secure essential tools: Obtain crucial technology before prices rise or stock depletes

Start leveraging assets: Use the equipment to drive business operations immediately

Considerations:

Higher initial costs: Expect to pay more for option fees and monthly payments

Limited availability: Fewer lease-to-own options may exist in the market

Ownership risks: You don't own the equipment until the purchase is finalized

Real Examples:

A startup needing new servers can access them right away, facilitating immediate business operations. Or a manufacturing firm can quickly scale up production by acquiring necessary machinery through lease-to-own.

Market Trends:

More businesses are considering lease-to-own as traditional purchasing becomes more challenging. Rising equipment costs and supply chain issues have increased interest in alternative acquisition methods.

Essential Tips:

Review contracts: Understand payment structures and purchase prices before signing

Pre-approval options: Ensure financing is available for the eventual purchase

Legal assistance: Engage legal experts to protect your interests

Immediate usage through lease-to-own provides a practical solution for businesses needing quick access to essential equipment.

Related posts

Ready To Join The Circular Movement?

United for a smarter shopping experience and a better planet