Lease Electronics: Affordable Access to Premium Tech

Patricia Bernal

Mar 25, 2025

Why Electronics Leasing Is Transforming How We Access Tech

The way we acquire and use technology is changing. We're moving away from traditional ownership and toward a more flexible model: electronics leasing. This shift isn't just a passing trend; it signifies a fundamental change in how we interact with technology. Why are consumers and businesses increasingly choosing access over ownership?

The Economics of Access

Cost is a major factor in this shift. Buying the latest gadgets, like smartphones or laptops, can be expensive. Leasing offers a more budget-friendly alternative, spreading the cost over time with predictable monthly payments. This allows people and businesses to use premium technology without breaking the bank.

The electronics rental market is also experiencing significant growth. In 2024, the global market value was estimated at USD 66,152.6 million. Projections indicate this will reach USD 159,169.7 million by 2032, representing a compound annual growth rate (CAGR) of 11.60%. The high cost of new electronics and the rapid pace of technological advancement fuel this impressive growth. Learn more: Electronics Products Rentals Market Trends and Future Opportunities. This data clearly shows that consumers are recognizing the financial advantages of leasing.

Staying Ahead of the Curve

The constant influx of new technology is another reason for the increasing popularity of electronics leasing. New devices are always being released, making older models obsolete very quickly. This cycle of obsolescence makes purchasing electronics a gamble. For instance, a high-end computer purchased today could be outdated in just a couple of years. Leasing provides a practical solution to this issue.

Sustainability and the Circular Economy

Leasing electronics also addresses growing environmental concerns. It supports a more circular economy by enabling the reuse and refurbishment of devices. This reduces electronic waste and lessens the environmental footprint of manufacturing new gadgets. This approach is beneficial for the environment and businesses, as they can profit from the second-hand market and encourage responsible consumption. Further information can be found here: Electronics Rental: The Smart Choice for Businesses and Consumers in 2025. Leasing offers a responsible and financially smart way to manage technology lifecycles.

Flexibility and Adaptability

Leasing offers a degree of flexibility that traditional ownership lacks. Users can easily upgrade to the newest models as they are released, ensuring access to the latest features. This is particularly important for businesses that need cutting-edge technology to stay competitive. This adaptability is essential in today's business world, enabling organizations to respond to changing market needs and technological advancements.

The Hidden Financial Advantages of Leasing vs. Buying

Flexibility and Adaptability

Leasing offers a degree of flexibility that traditional ownership lacks. Users can easily upgrade to the newest models as they are released, ensuring access to the latest features. This is particularly important for businesses that need cutting-edge technology to stay competitive. This adaptability is essential in today's business world, enabling organizations to respond to changing market needs and technological advancements.

The Hidden Financial Advantages of Leasing vs. Buying

Beyond the lower initial cost, leasing electronics offers several financial benefits that often go unnoticed. Savvy consumers and businesses are increasingly using these advantages to optimize their tech budgets and keep up with the latest advancements. This involves understanding the roles of depreciation, taxes, and lifecycle management in making informed decisions.

Depreciation: The Silent Cost of Ownership

One of the biggest hidden costs of buying electronics is depreciation. Electronics, particularly in fast-moving sectors like smartphones and computers, lose value rapidly. This means the resale value of your device can drop significantly in a short time. Leasing, on the other hand, shifts the burden of depreciation onto the leasing company. This allows you to always have access to current technology without being tied to a depreciating asset.

Tax Benefits: Unlocking Potential Savings

Depending on your location and the specific lease agreement, leasing electronics can offer valuable tax advantages. Lease payments are sometimes considered operational expenses and are potentially deductible against business income. This can result in substantial savings over the long term, making leasing an even more attractive financial option. For instance, businesses can deduct lease payments as operating expenses, effectively lowering their taxable income. This is a major financial benefit often overlooked. For more information, check out this helpful guide on the benefits of renting vs. owning.

Lifecycle Management: Staying Current, Strategically

Managing the lifecycle of electronic devices can be complicated and expensive. Leasing simplifies this process by offering built-in upgrade options. This eliminates the hassle of selling or disposing of old equipment. Furthermore, many lease agreements include maintenance and technical support, minimizing downtime and unexpected repair bills.

The Growth of the Leasing Market

The electronics leasing market is experiencing rapid expansion. From 2020 to 2025, the market grew at a CAGR of 1.4%, reaching an estimated $9.8 billion in 2025. More information on this growing market is available in this report on the Consumer Electronics and Appliances Rental Industry in the US. This growth reflects a significant change in consumer and business preferences, moving away from traditional ownership towards more flexible access.

To illustrate the cost differences, let's look at a comparison of leasing versus buying over a three-year period.

Cost Comparison: Leasing vs. Buying Electronics

This table compares the financial implications of leasing versus buying common electronic devices over a 3-year period.

Device Type | Purchase Price | 3-Year Lease Total | Residual Value | Net Cost Difference |

|---|---|---|---|---|

Smartphone | $1,000 | $720 | $100 | $180 |

Laptop | $1,500 | $1,080 | $200 | $220 |

Tablet | $500 | $360 | $50 | $90 |

As you can see, leasing can result in significant savings, particularly for more expensive devices. The residual value, or the value of the device after the lease term, is often low, further emphasizing the financial benefits of leasing.

When Leasing Makes Financial Sense

Leasing is especially advantageous for technology that evolves quickly, equipment with a short lifespan, or when budget predictability is crucial. For businesses, leasing frees up capital for core operations, allowing for greater financial flexibility. It also provides access to cutting-edge technology without the significant upfront investment needed for a purchase. This enables both businesses and individuals to stretch their budgets and stay competitive. Understanding the financial implications of leasing allows you to make the best decisions based on your needs and goals.

Premium Tech Categories Where Leasing Makes Brilliant Sense

Leasing electronics isn't a universal solution. Some tech categories offer more value when leased compared to others. It's crucial to understand which devices provide the best lease options based on factors like depreciation, upgrade cycles, and maintenance.

High-End Laptops and Desktops: Power Without the Price Tag

High-end laptops and desktops are essential for creative professionals and businesses, but they depreciate quickly. Leasing these powerful machines provides access to the latest processing power and software without a large upfront investment. Users also avoid the worry of resale values plummeting.

This is particularly helpful for businesses needing top-tier equipment to maintain a competitive edge. For instance, video editors can lease high-performance computers to run demanding software without owning hardware that rapidly becomes obsolete.

Professional Cameras and Equipment: Capturing the Moment Affordably

Professional cameras and accessories are another category where leasing makes financial sense. Purchasing these items outright is expensive, and new models with enhanced features are released frequently. Leasing provides photographers and videographers with access to state-of-the-art equipment without the financial strain of constant upgrades.

Many leasing options also include maintenance and repairs, protecting users from unexpected costs.

Enterprise Systems: Scalability and Flexibility

Businesses often need complex enterprise systems, which can be costly to implement and maintain. Leasing these systems offers scalability and flexibility. As companies expand, their technology needs change. Leasing allows for smooth upgrades and adjustments to meet these evolving requirements. This ensures efficiency and minimizes the risk of outdated infrastructure.

This adaptability is key in the dynamic business world.

Specialized Equipment: Access to Niche Technology

Specialized equipment, like medical devices or scientific instruments, is often pricey and has a limited lifespan. Leasing offers access to this niche technology without the long-term financial commitment of ownership. Lease agreements can also include specialized maintenance and support services designed for these specific devices.

This added benefit can greatly improve operational efficiency and minimize downtime.

Emerging Technologies: Exploring the Future of Leasing

Emerging technologies, such as AR/VR equipment and professional-grade smart home systems, present exciting opportunities. However, their rapid development makes ownership a risky investment. Leasing allows users to experience these innovations without being tied to soon-to-be-obsolete hardware.

This lets individuals and businesses explore new technologies with minimal risk and determine their practical applications cost-effectively. As these technologies evolve, leasing offers a flexible path for ongoing upgrades and adoption. By strategically leasing electronics in these categories, both individuals and businesses can optimize their technology budgets, keep up with innovation, and gain a competitive advantage.

Beyond Hardware: The Service Ecosystem That Makes Leasing Shine

The real benefit of leasing electronics isn't simply getting the newest gadgets. It's about the comprehensive service ecosystem that accompanies it. These value-added services can substantially improve the overall experience and lower the total cost of ownership, making leasing a compelling option.

Support and Maintenance: Minimizing Downtime

One of the most valuable aspects of leasing electronics is the inclusion of technical support and preventative maintenance. Imagine a technical problem with your leased laptop. Instead of searching for a repair shop and paying for the fix, you simply contact your leasing provider for priority support. They diagnose the problem and, if necessary, dispatch a technician for a quick resolution, minimizing disruptions. Preventative maintenance ensures the smooth operation of your devices through regular checkups and software updates, identifying potential issues before they escalate.

Data and Security: Protecting Your Information

Many leasing providers offer data migration assistance and cybersecurity safeguards within their service packages. This is especially helpful when upgrading to new equipment. Transferring data from an old device to a new one can be tedious and complex. Leasing providers often provide expert help to ensure a smooth transition, protecting your valuable data and minimizing downtime. Furthermore, integrated cybersecurity software and services provide added protection against online threats.

Seamless Transitions: Effortless Upgrades

Leasing electronics simplifies upgrades. When your lease ends, or a newer model is released, the transition is often smooth and efficient. The leasing company handles the logistics of returning old equipment and delivering new devices, saving you the hassle of selling or disposing of outdated tech. This ensures you always have access to the latest technology without managing the upgrade cycle. The rental model also provides perks such as maintenance and repairs, further improving the experience. Learn more about this growing market: Electronic Products Rental Market. This added value can be a key deciding factor for those considering leasing.

Evaluating Service Packages: Finding The Right Fit

Not every service package is the same. When considering leasing, carefully evaluate the included services and decide which ones offer a true return on investment (ROI). Think about your usage patterns, potential technical difficulties, and the importance of data security. Some leasing providers offer customizable service packages, allowing you to select specific services that align with your needs and budget. This creates a leasing agreement that delivers maximum value and minimizes unnecessary costs.

Negotiating Support Terms: Protecting Your Interests

Negotiating strong support terms is essential to the leasing process. Discuss the service agreement details with your provider. Clarify support response times, understand the scope of covered repairs, and confirm the contract addresses equipment failure or unforeseen events. A clear service agreement protects you throughout the lease and ensures a positive experience. By understanding the services surrounding electronics leasing, you can make informed choices, maximize your lease's value, and enjoy the convenience and peace of mind from comprehensive support.

Finding Your Perfect Lease Electronics Partner

Not all electronics leasing providers are created equal. Choosing the wrong one can quickly turn a convenient solution into a major headache. It's essential to understand the key factors that separate a reliable partner from a problematic one. This requires careful research and a good understanding of the leasing industry. For more information on common rental challenges and solutions, check out our article on renting issues in business and their solutions.

Key Questions To Ask Potential Leasing Partners

Asking the right questions upfront can save you time and money by revealing potential issues before they become major problems. Financial stability is a critical factor. Inquire about the company's history and financial health. A financially secure partner is more likely to provide consistent service and fulfill their obligations.

Another important aspect is inventory quality. Ask about the age and condition of the equipment. You want to ensure you're receiving reliable technology, not outdated or poorly maintained devices. Don't hesitate to ask for details about their refurbishment process if they offer certified pre-owned devices.

Understanding their maintenance procedures is also essential. A responsive partner will offer prompt maintenance and technical support to minimize downtime and keep your operations running smoothly. Ask about their typical response times and what kind of support they provide.

Finally, consider their contract flexibility. Look for options that allow for upgrades and adjustments as your business needs change. The ability to adapt to evolving technology is crucial for long-term success.

Red Flags To Watch Out For

While tempting deals can be enticing, it's vital to be aware of potential red flags. Unusually low prices may indicate low-quality equipment or hidden fees. Vague contract terms can create disputes and complications later on. A lack of open and honest communication can be a sign of bigger problems. Being aware of these warning signs can help you avoid unfavorable agreements.

Evaluating Different Provider Types

There are several types of lease electronics providers, each with its own pros and cons. Manufacturer-direct programs often offer specialized expertise and access to the newest models. However, their equipment selection may be limited. Specialized third-party providers, on the other hand, usually offer a wider range of equipment but may not have the same in-depth product knowledge. Choose the type of provider that best aligns with your specific needs and priorities.

Building A Long-Term Relationship

Choosing a leasing partner isn't just a transaction; it's the start of a long-term relationship. Consider the provider's commitment to customer service. Do they prioritize customer satisfaction? Do they provide ongoing support and guidance? A successful long-term partnership is built on trust, transparency, and mutual benefit.

Framework For Decision-Making

To make the decision process easier, create a structured framework. Develop a checklist of essential criteria, such as financial stability, inventory quality, maintenance responsiveness, and contract flexibility. Prioritize each criterion based on your specific needs.

The following table provides an example of a comparison checklist:

Electronics Leasing Provider Comparison Checklist: A comprehensive evaluation framework for comparing different electronics leasing companies

Evaluation Criteria | Questions to Ask | Importance Rating | Notes |

|---|---|---|---|

Financial Stability | How long have they been in business? What are their financial ratings? | High | Ensures long-term reliability |

Inventory Quality | What is the age and condition of their equipment? Do they offer certified refurbished devices? | Medium | Impacts performance and reliability |

Maintenance Responsiveness | What is their support response time? Do they offer on-site support? | High | Minimizes downtime |

Contract Flexibility | Do they offer upgrade options? Can the lease terms be adjusted? | Medium | Allows for changing needs |

Customer Service | How do they handle customer inquiries and complaints? Do they have positive reviews? | High | Ensures a positive experience |

This checklist helps you compare potential partners based on factors crucial for a successful leasing arrangement. By weighing the importance of each criterion, you can make a more informed decision.

By following these guidelines, you can confidently navigate the lease electronics market and find a partner that supports your business or personal technology needs.

Mastering Lease Agreements: What the Fine Print Really Means

Smart leasing for electronics hinges on understanding the details. This section breaks down the complexities of lease agreements, empowering you to navigate the fine print and negotiate effectively. A well-informed lessee is a protected lessee.

Decoding The Legal Jargon

Lease agreements are dense with legal terminology. Understanding key terms like liability, equipment condition, and end-of-term obligations is essential. For example, vague language around liability can expose you to unexpected costs. Similarly, poorly defined equipment condition descriptions can lead to disputes over wear and tear.

Liability: Protecting Yourself From Unforeseen Costs

Liability clauses outline who is responsible for damage or loss. Ensure your agreement clearly distinguishes between normal wear and tear and damage for which you are liable. Also, clarify who is responsible for repairs due to malfunctions or defects. This protects you from unexpected costs and clearly defines responsibility.

Equipment Condition: Documenting Everything

Before signing, meticulously document the equipment's condition. Take photos and videos, noting any existing imperfections. This documentation is key to resolving potential disputes about the equipment's condition upon return. This proactive approach can save you from unfair charges.

Insurance Requirements: Understanding Your Coverage

Many lease agreements mandate insurance for the leased electronics. Carefully review these requirements and compare them with your existing coverage. This can prevent you from paying for unnecessary duplicate insurance. Negotiating the insurance terms can be beneficial, ensuring the required coverage aligns with the actual risk.

End-Of-Term Obligations: Planning Your Next Move

End-of-term obligations are critical. These details outline the return process, applicable fees, and options for extending or upgrading the lease. Understanding these conditions in advance helps you plan your next step, whether it’s returning, upgrading, or extending. This ensures a smooth transition and avoids surprise charges.

Negotiating For Better Terms

Don't hesitate to negotiate. Everything from the monthly payment to the end-of-term options is up for discussion. If you anticipate a long-term lease, negotiating a lower monthly payment or a buyout option can be advantageous. Clearly stating your needs and being prepared to walk away can often secure a better deal.

Creating A Win-Win Situation

Leasing electronics should benefit both parties. By understanding your rights and responsibilities, and thoroughly reviewing the agreement, you can establish a mutually beneficial leasing relationship. This paves the way for a successful and satisfying leasing experience.

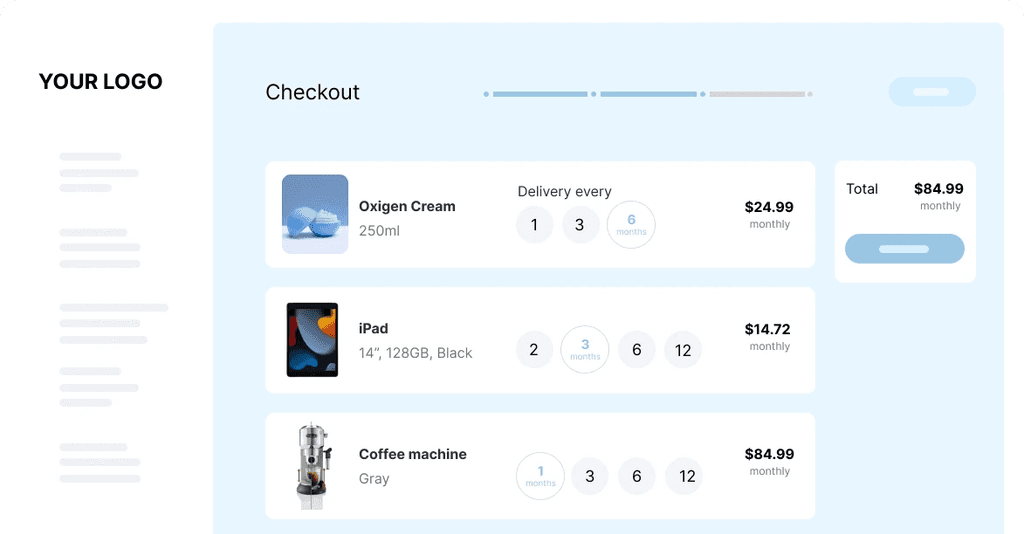

Looking for a seamless leasing solution for your customers? Sharpei offers innovative payment solutions that benefit both merchants and customers. Learn more and transform your business.

Sharpei can help streamline your subscription business by providing a flexible payment solution for a variety of subscription models. Sharpei's platform integrates with your existing storefront, letting you easily manage recurring billing, offer different subscription tiers, and improve the customer experience. Learn more about how Sharpei can help your subscription business thrive.

👉 Curious how Sharpei stacks up for your business?

Sharpei offers a flexible payment platform that helps merchants adapt to these evolving B2B leasing trends. Learn how Sharpei can help your business succeed at https://www.gosharpei.com.

Start your 14-day free trial today.

Related posts

Ready To Join The Circular Movement?

United for a smarter shopping experience and a better planet