How to Calculate Customer Acquisition Cost: A Complete Guide for Businesses

Patricia Bernal

Feb 12, 2025

Understanding Customer Acquisition Cost (CAC) Fundamentals

Customer Acquisition Cost (CAC) shows how much money your business spends to get a new customer. This essential metric helps you evaluate if your marketing and sales efforts are working well. By tracking your CAC carefully, you can spot ways to improve your spending and get better results from your budget.

Why is CAC Important?

Your CAC directly affects how profitable your business can be. High acquisition costs eat into your margins, while lower costs mean more efficient growth. Looking at CAC alongside customer lifetime value (LTV) tells you if you're spending the right amount to bring in new customers who will generate enough revenue over time.

How CAC is Calculated

The basic CAC formula is straightforward: Total Marketing and Sales Costs divided by Number of New Customers Acquired. For example, if you spend $10,000 on marketing and sales in one month and gain 100 new customers, your CAC is $100 per customer. The tricky part is making sure you count all your relevant costs.

Factors Affecting CAC Calculation

Your industry, time period, and cost categories all shape your CAC numbers. Different businesses measure CAC in different ways - software companies might look at quarterly figures, while online stores often track monthly costs. Pick a timeframe that matches your business cycles and gives you useful data for planning. Learn more about industry benchmarks from UserPilot's analysis of average customer acquisition costs.

Key Components of CAC

To calculate CAC accurately, include both direct and indirect costs. Direct costs like advertising spend and sales commissions are easy to track. Indirect costs matter just as much - think salaries, content creation, and software tools. Missing these hidden costs can make your CAC look better than it really is and lead to poor spending decisions. Getting the full picture helps you make smart choices about where to invest your resources.

Step-by-Step Guide to Calculating CAC

Understanding how to calculate your Customer Acquisition Cost (CAC) is essential for any business. This guide breaks down the process into simple, actionable steps you can follow to track this key metric.

Identify a Specific Time Period

Pick a timeframe that makes sense for your business cycles - this could be monthly, quarterly, or yearly. For example, if you run an e-commerce store with quick sales cycles, monthly tracking might work best. But for B2B companies with longer sales processes, quarterly or annual periods often make more sense. Stay consistent with your chosen timeframe to spot trends effectively.

Determine Your Total Marketing and Sales Costs

Add up every expense related to finding and converting new customers during your chosen period. Include direct costs like ad spending and sales commissions, plus indirect costs such as marketing team salaries, content creation, and software subscriptions. Being thorough with your cost tracking gives you the most accurate picture of your true acquisition expenses.

Calculate the Number of New Customers Acquired

Count how many new paying customers you gained in the same period. Remember to only include actual paying customers - don't count free trial users or leads who haven't purchased yet. This helps ensure your CAC reflects what you're really spending to gain revenue-generating customers.

Apply the CAC Formula

Now for the simple math: divide your total costs by your number of new customers. For instance, if you spent $250,000 on marketing and sales last quarter and gained 500 new customers, your CAC would be $500 per customer. Here's another example: A company spent $150,000 on marketing plus $100,000 on sales ($250,000 total) and acquired 300 new customers, making their CAC $833 ($250,000 ÷ 300). For more insights, check out Zendesk's blog post on customer acquisition cost.

Analyzing Your CAC

Knowing your CAC is just the start - you need to understand what it means for your business. A higher CAC isn't always bad, especially if you sell premium products or services. What matters most is tracking changes over time and watching for big increases that might signal problems with your acquisition strategy. You can offset higher CACs by increasing how much customers spend - check out our guide on How to Increase Average Order Value for practical tips to boost revenue per customer.

Essential Cost Components to Include

Getting your Customer Acquisition Cost (CAC) right means tracking every expense involved in bringing in new customers. While many businesses focus only on marketing spend, an accurate CAC calculation needs to account for both direct and indirect costs. Let's break down what you need to include to get the full picture.

Direct Costs: The Basic Building Blocks

These are the straightforward expenses that directly connect to finding and converting new customers:

Advertising Expenses: This covers your PPC campaigns, social media ads, display ads, and other paid marketing

Sales Team Commissions: Money paid to sales staff for bringing in new customers

Affiliate Payouts: Fees given to partners who refer new business your way

Acquisition-Focused Content: Costs for creating landing pages, lead magnets, and other materials specifically made to attract customers (including writers and designers)

Indirect Costs: Hidden But Important

While these costs may be less obvious, leaving them out will give you an incomplete view of your true acquisition expenses:

Marketing Staff Costs: Factor in the portion of marketing team salaries dedicated to acquisition work

Tech Stack Expenses: Include your CRM, email platform, analytics tools, and other marketing software costs

Basic Operating Costs: Calculate the share of office space, utilities, and general expenses that support your marketing and sales

Building Your Cost Tracking System

To get CAC right, you need a reliable way to capture all these expenses. The basic formula is: CAC = (Cost of sales + Cost of marketing) ÷ Number of new customers. This helps you evaluate if your acquisition strategies are working effectively. Learn more details about CAC on HubSpot's blog.

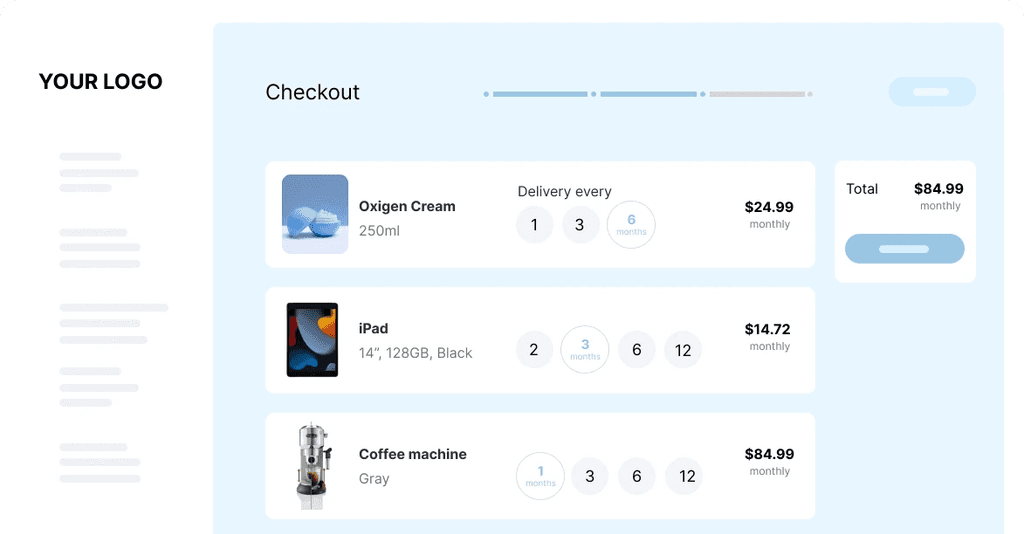

Want to see how this fits into a bigger revenue picture? Check out our guide on How to Master Recurring Revenue Business Models.

By carefully tracking both direct and indirect costs, you'll understand exactly what you're spending to acquire each customer. This knowledge helps you make smarter choices about where to invest your marketing and sales budget for the best returns.

Common CAC Calculation Mistakes and How to Avoid Them

Getting your Customer Acquisition Cost (CAC) calculations right is essential for smart business planning. Unfortunately, many companies make mistakes that can throw off their numbers and lead them down the wrong path. Let's look at the main errors to watch out for and how to fix them.

Inconsistent Timeframes

One big mistake is mixing different time periods when measuring costs and new customers. For example, if you compare your January marketing spend against customer growth from January through March, your CAC numbers won't make sense. Pick a consistent period - monthly, quarterly, or yearly - that matches your typical sales cycle and stick with it.

Overlooking Indirect Costs

Many businesses only count obvious expenses like ad spend in their CAC. They forget about indirect costs such as staff salaries, software tools, and content creation. These hidden expenses can really add up. To get accurate numbers, track everything that goes into acquiring customers, both direct and indirect costs.

Misattributing Customer Acquisition

Don't assume all new customers came from your latest marketing campaign. Some people find your business through word-of-mouth or organic search, even during active promotions. Use proper tracking tools like UTM parameters in your online campaigns to see exactly where customers are coming from. This helps you understand which channels work best and allocate costs correctly.

Failing to Segment Customers

Using one big CAC number for all customers hides important details. Different customer groups often cost different amounts to acquire. For instance, social media ads might bring in customers more cheaply than trade shows. Break down your CAC by customer type, marketing channel, or other key factors to spot your most cost-effective approaches.

Not Regularly Reviewing Your CAC

Many companies calculate their CAC once and forget about it. This is a mistake since acquisition costs change with market conditions and seasons. Set up regular CAC reviews to spot trends, catch problems early, and adjust your strategy when needed. This ongoing monitoring helps you spend wisely and get better returns on your marketing investment.

Transforming CAC Data Into Strategic Insights

Getting the most from your Customer Acquisition Cost (CAC) goes far beyond basic math. When analyzed properly, this key metric reveals critical insights about your marketing effectiveness, sales performance, and business health that can guide smart decisions and fuel growth.

Benchmarking Your CAC

Looking at CAC numbers alone only tells part of the story. To truly evaluate performance, compare your metrics against industry standards and competitors. A CAC that's much higher than average may signal problems with your acquisition approach, while beating the competition could mean you've found a winning formula. These comparisons provide essential context to guide improvements.

Identifying Opportunities for Improvement

After benchmarking, the next step is finding specific areas to enhance. High CAC could stem from ineffective marketing, long sales cycles, or poor customer targeting. Break down your CAC data by channel, customer segment, and product line to spot trouble spots. For example, if social media campaigns cost more per customer than email marketing, you can shift resources to the better-performing channel for improved ROI.

Developing Action Plans

Data insights only matter if you act on them. Create concrete plans to address CAC issues you uncover. If paid ads have high costs, test new creative approaches, refine audience targeting, or try different ad platforms. For lengthy sales cycles, implement automation tools or streamline your process. Check out our guide on How to Increase Customer Lifetime Value for more revenue growth strategies. Make your action plans SMART (Specific, Measurable, Achievable, Relevant, Time-bound) to track progress effectively.

Communicating CAC Insights

Getting buy-in requires clear communication of CAC findings to stakeholders. Present your analysis in a straightforward way that connects to business goals. Use visual aids like charts to make complex data easier to grasp. Show how optimizing CAC directly impacts profits, marketing ROI, and sustainable growth. When you demonstrate the real value of CAC analysis, you can turn insights into action and build data-driven decision making across your organization. For more perspective, see our article on How to Master Recurring Revenue Business Models to understand CAC's role in your revenue strategy.

Advanced CAC Analysis and Future-Proofing Your Strategy

Getting smarter about Customer Acquisition Cost (CAC) goes beyond basic metrics. When you connect CAC with other key business data, you gain valuable insights into how effectively you're growing your customer base.

Connecting CAC to Business Success

The relationship between CAC and other metrics tells an important story. Most experts suggest aiming for a 3:1 ratio between customer lifetime value (LTV) and CAC. This means each customer should generate three times more value than what you spent to acquire them. Keeping track of this ratio helps you build sustainable growth by showing if your acquisition spending makes financial sense.

New Ways to Measure CAC

Smart businesses are getting better at measuring CAC by using data analysis tools. These tools look at past customer behavior to spot patterns and predict future trends. For instance, new software can detect shifts in how customers respond to marketing, letting you adjust your CAC strategy before problems arise.

Smart Ways to Control Costs

Many companies now focus on getting more value from their acquisition spending. Marketing automation helps cut costs while maintaining quality. Companies that regularly test and improve their marketing report much lower costs per new customer.

Building a CAC Strategy That Lasts

Markets change constantly, so your approach to tracking and improving CAC needs to stay flexible. Create a system for ongoing improvement with regular reviews of what's working and what isn't. Pay attention to economic changes and new competition, and be ready to shift your customer acquisition tactics when needed.

By following these practical steps, you can build a CAC strategy that works well now and adapts to future changes. To learn more about adding flexible payment options to your business, check out Sharpei's solutions.

Related posts

Ready To Join The Circular Movement?

United for a smarter shopping experience and a better planet