Expert Tactics to Reduce Subscription Churn

Patricia Bernal

Apr 23, 2025

Decoding Subscription Churn: Types and Industry Benchmarks

Understanding subscription churn is crucial for any recurring revenue business. It signifies more than lost subscribers; it directly impacts your predictable income. Dissecting the why behind churn is the first step towards effective mitigation. A key distinction lies between voluntary churn and involuntary churn.

Voluntary churn occurs when a customer actively cancels their subscription. Reasons can include dissatisfaction with the product or service, finding a better alternative, or no longer needing the subscription. For example, a customer might cancel a meal kit subscription after learning to cook. Pricing also plays a role; customers might switch to competitors offering similar products for less.

Involuntary churn happens when subscriptions are canceled due to failed payments. This can be caused by expired credit cards, insufficient funds, or payment gateway issues. It often occurs without the customer's intent to cancel, creating a silent revenue drain. However, much involuntary churn is recoverable with the right strategies. Understanding these churn types is critical for targeted retention.

Industry benchmarks provide context for your churn rates. Subscription churn statistics show that average monthly churn varies by industry. Direct-to-Consumer (D2C) businesses typically experience higher churn than Business-to-Business (B2B) services. D2C businesses average 6% to 8% monthly churn, while B2B companies see rates closer to 3.8%.

A critical factor influencing churn is its voluntary or involuntary nature. Addressing both is essential for effective retention. For instance, Recurly reported saving 72% of at-risk subscribers in 2023 through proactive recovery. This highlights the different customer dynamics and buying cycles in B2B and D2C markets. You can find more detailed statistics here: Learn more about industry churn rate benchmarks.

To better understand your own churn rates in context, let's look at some industry averages. The following table presents a comparison of monthly and annual churn rates across various subscription business models, along with key factors that often contribute to churn in each sector.

Industry-Specific Churn Rate Benchmarks Comparison of average monthly churn rates across different subscription business models:

Industry/Business Model | Average Monthly Churn Rate (%) | Annual Churn Rate (%) | Key Churn Factors |

|---|---|---|---|

Streaming Services (e.g., Netflix, Spotify) | 5-7 | 60-84 | Content library, pricing, competition |

SaaS (Software as a Service) | 3-5 | 36-60 | Features, customer support, value proposition |

Subscription Boxes (e.g., meal kits, beauty products) | 6-8 | 72-96 | Product satisfaction, novelty, pricing |

Online Fitness/Wellness | 7-9 | 84-108 | Engagement, results, alternative options |

B2B Services | ~3.8 | ~45.6 | Contract terms, ROI, changing business needs |

This table illustrates the wide range of churn rates across different industries. While B2B services generally exhibit lower churn, industries like online fitness and subscription boxes face higher churn due to factors like competition and customer engagement.

Understanding the Nuances of Churn

Different price points and customer segments also experience varying churn patterns. Premium plan customers might exhibit lower churn due to higher perceived value and investment. Understanding the specific drivers of churn within your customer base is crucial for developing effective retention strategies.

The Financial Power of Reducing Subscription Churn

Let's move beyond simply counting subscribers and delve into how reducing churn directly affects your bottom line. This isn't about vanity metrics. It's about understanding the real financial impact of keeping your subscribers engaged and satisfied. Even small improvements in customer retention can lead to substantial revenue growth over the long haul.

The Mathematics of Customer Lifetime Value

One of the most compelling arguments for focusing on churn reduction is its impact on Customer Lifetime Value (CLTV). CLTV represents the total revenue you can expect from a single customer throughout their entire relationship with your business. Even a small percentage improvement in retention can significantly boost this value.

Think of CLTV like compound interest. Small gains accumulate over time, resulting in impressive long-term growth. For example, if your average customer spends $50 per month and remains subscribed for one year, their CLTV is $600. If you increase their subscription lifespan to two years through effective churn reduction, their CLTV doubles to $1200. This clearly illustrates the importance of retention for long-term profitability.

Quantifying the True Cost of Churn

Successful subscription businesses recognize that acquiring new customers is considerably more expensive than retaining existing ones. Studies show acquiring a new customer can cost five times more than keeping a current one. This highlights the need to prioritize customer retention efforts.

One compelling example of effective churn reduction is HelloFresh. While Blue Apron struggled with customer retention, HelloFresh thrived by implementing targeted retention strategies. Find more detailed statistics here. Reducing churn by just 5% can increase profits by a staggering 25% to 95%.

To further illustrate the financial impact of various churn reduction percentages, let's examine the following table:

Financial Impact of Churn Reduction

How different churn reduction percentages affect revenue growth and profitability

Churn Reduction (%) | Annual Revenue Impact ($) | 5-Year Profit Increase (%) | Customer Lifetime Value Increase (%) |

|---|---|---|---|

5% | $100,000 | 25% | 10% |

10% | $200,000 | 50% | 21% |

15% | $300,000 | 75% | 33% |

20% | $400,000 | 95% | 46% |

Note: These figures are illustrative and will vary based on specific business models and data.

As this table demonstrates, even incremental reductions in churn can lead to substantial improvements in revenue, profitability, and CLTV. Investing in strategies to retain customers clearly pays off.

Building the Business Case for Retention

By quantifying both the cost of churn and the potential return on investment (ROI) from retention initiatives, you can create a compelling business case for investing in customer loyalty. Show how even small improvements in retention can dramatically affect your bottom line.

This shift from focusing solely on acquisition to prioritizing retention is essential for subscription businesses. It can dramatically impact financial performance and long-term sustainability. This translates into tangible financial projections that will resonate with stakeholders.

Harnessing Data to Predict and Prevent Subscriber Exodus

Understanding churn types and their financial impact is just the first step. The real power lies in prediction and prevention. This is where data becomes invaluable in combating subscriber loss. Forward-thinking subscription businesses don't just react to cancellations; they anticipate them.

Identifying At-Risk Subscribers: Early Warning Signs

Think of subscriber churn like a leaky faucet. You can constantly mop up the spills, or you can fix the leak. Addressing churn effectively means identifying the "leaks" in your subscriber base – those telling behavioral signals and engagement patterns that indicate risk before cancellation even crosses a subscriber's mind.

These signals can vary. A sudden drop in logins for a software service or decreased content consumption on a streaming platform might suggest disengagement. Negative feedback or a spike in support tickets could point to underlying dissatisfaction. Recognizing these patterns is the key to timely intervention.

Building Predictive Models With Existing Data

You likely already have the data to build these early warning systems. Whether you're a startup or a large enterprise, customer actions generate valuable insights. Data-driven strategies are essential for reducing churn. Platforms like Subbly offer features like AI churn predictions and cancellation mitigation. Learn more about using data to reduce churn. Analyzing the link between feature adoption and retention is key. For instance, Subbly merchants utilizing a high percentage of features experience lower average churn, highlighting the power of data-driven predictive analysis.

Practical Approaches to Data-Driven Intervention

Once you've identified at-risk subscribers, the next step is intervention. This isn't about mass emails; it's about delivering targeted value based on the reasons behind potential churn.

Personalized Offers: Tailor promotions or discounts based on individual usage. Offer a free month of a premium feature an at-risk subscriber hasn't used.

Proactive Customer Support: Reach out to customers with negative sentiment to address their concerns and provide personalized solutions. Turning a negative into a positive can make all the difference.

Targeted Content and Education: Re-engage users showing signs of decreased product usage with valuable content or tutorials highlighting features and benefits they might be missing.

Feedback and Improvement: Use data to understand churn's root causes and pinpoint areas for product improvement. Addressing these underlying issues can dramatically impact overall retention. Learn more about increasing customer retention.

Implementing Effective Prediction Models: A Step-by-Step Guide

Building these models requires a structured approach:

Data Collection: Gather relevant data from various sources like CRM systems, website analytics, and payment gateways.

Feature Engineering: Identify key variables correlating with churn, such as login frequency, feature usage, support interactions, and payment history.

Model Selection: Choose suitable machine learning algorithms for churn prediction, like logistic regression, decision trees, or more advanced methods.

Model Training and Evaluation: Train your model on historical churn data and evaluate its performance using appropriate metrics.

Deployment and Monitoring: Deploy your model to predict churn in real-time and constantly monitor its accuracy and effectiveness.

By following these steps, you can use your data to predict and prevent churn, maximizing customer lifetime value and building a more sustainable business.

Crafting Onboarding Experiences That Hook Subscribers

The first 90 days of a subscriber's journey are often the most telling when it comes to long-term success and reducing subscription churn. These initial interactions are your chance to turn new customers into loyal brand advocates. This section delves into how successful subscription businesses create compelling onboarding experiences that build strong relationships from the start.

Identifying the "Aha!" Moment

Effective onboarding hinges on identifying your product's "aha!" moment. This is the pivotal point where a subscriber grasps the core value and experiences the key benefit. For project management software, it might be the successful completion of that first team project. For a meal kit service, it could be savoring the first delicious, home-cooked meal. Pinpointing this moment and guiding subscribers towards it is crucial for retention.

Understanding this "aha!" moment is closely tied to reducing churn. When users experience value early, they are far more likely to remain engaged. This allows you to tailor the onboarding process to guide them to this realization quickly and smoothly.

Personalized Onboarding Pathways: One Size Doesn't Fit All

Just as your customer segments are diverse, their onboarding experiences should be too. Personalized pathways cater to individual needs and preferences, boosting engagement and minimizing those initial friction points. For example, a software service might offer separate onboarding flows for individuals and teams, highlighting the most relevant features for each.

Think of onboarding as tailoring a suit. A generic, off-the-rack experience won't fit everyone properly, leading to discomfort and potentially, rejection. A tailored onboarding experience, however, fits perfectly, increasing comfort and the likelihood of continued use.

Balancing Feature Education With Engagement

Onboarding requires a careful balance. While educating subscribers about features is crucial, bombarding them with too much information too soon can be overwhelming. Focus on demonstrating core value first. Then, gradually introduce additional features as the subscriber gains proficiency.

Imagine learning to ride a bike. You wouldn't begin by explaining complex mechanics. You'd start with the basics: balance and pedaling. Effective onboarding mirrors this approach, focusing on essential functions first and introducing advanced features later as the subscriber grows more comfortable.

Measuring Onboarding Effectiveness: Beyond the Surface

Measuring onboarding success goes beyond mere completion rates. It's about understanding how onboarding influences long-term retention. Key Performance Indicators (KPIs) like time-to-first-value, feature usage, and early engagement patterns are much more predictive of long-term success than simply finishing a tutorial.

Analyzing these metrics provides valuable insights into the effectiveness of your onboarding process. This data-driven approach allows for continual refinement, ultimately improving subscriber engagement and reducing churn. These principles apply across various subscription models, from content platforms to software services like Sharpei, helping businesses maximize the value they deliver to subscribers.

Conquering Involuntary Churn Through Smart Payment Recovery

While delivering exceptional customer experiences is crucial for minimizing voluntary churn, tackling involuntary churn requires a different strategy. This type of churn, often stemming from failed payments, typically happens without the customer's conscious decision to leave. This presents a significant opportunity for recovery. This section explores how smart payment recovery strategies can effectively reduce involuntary churn and recoup lost revenue.

Understanding the Science of Retry Timing

The timing of payment retries is paramount. Retrying too quickly might be futile if the original problem persists, but waiting too long increases the risk of losing the customer. Striking the right balance is essential. Studies suggest a staggered approach is most effective, starting with retries within a few days and progressively extending the intervals.

This staggered method gives customers time to rectify the root cause, such as updating card information or adding funds to their account. It also prevents overwhelming them with excessive payment attempts.

Communicating With Grace and Efficiency

Effective communication throughout the payment recovery process is vital. Instead of impersonal, generic emails, create messages that are empathetic and helpful. Clearly articulate the reason for the failed payment, present multiple solutions, and provide explicit instructions for updating payment details.

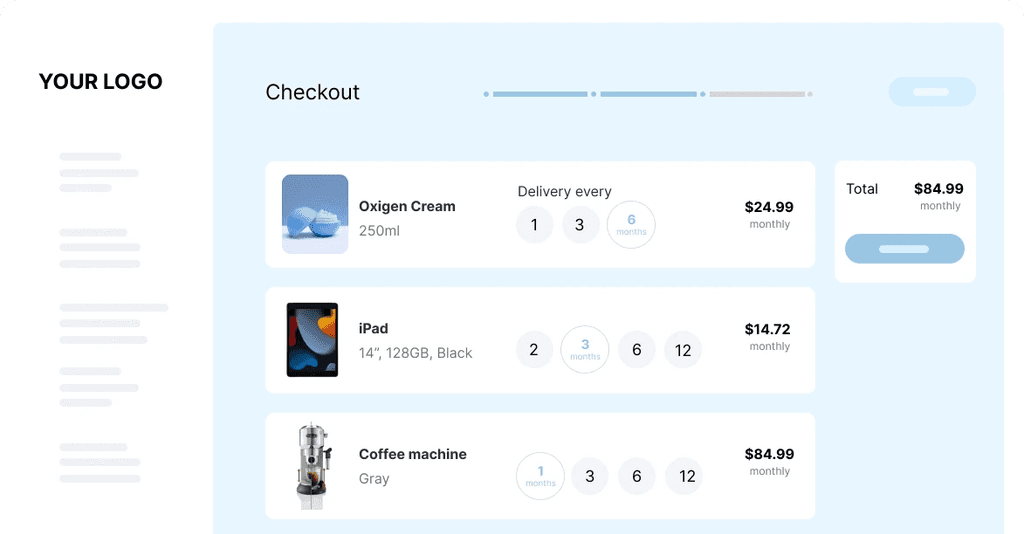

For instance, a well-designed email could begin by acknowledging the inconvenience and then offer direct links to a self-service portal like the one offered by Sharpei where customers can easily manage their payment information. This empowers the customer and simplifies the process.

Implementing Technical Solutions for Seamless Recovery

Technology is instrumental in mitigating involuntary churn. Card updater services automatically refresh expired or modified card details, preventing payment failures before they occur. Integrating these services can substantially decrease manual intervention. Similarly, intelligent retry logic analyzes historical payment data to optimize retry timing for each individual customer. This personalized method maximizes recovery while minimizing customer frustration.

Pre-dunning notifications, dispatched before the subscription renewal date, can further minimize involuntary churn. These notifications remind customers to update their payment information, preventing service interruptions and reducing the need for dunning altogether. This proactive approach demonstrates care and enhances the overall customer experience. By implementing these technical solutions, businesses can optimize the payment recovery process and reclaim a substantial portion of involuntary churn. This also fosters positive customer relationships, encouraging long-term retention and reducing churn.

Building Value-Driven Programs That Prevent Cancellations

Preventing subscription churn isn't about throwing discounts around or offering endless free trials. It's about building real value into your subscription that makes customers want to stay. This section explores how successful companies design loyalty initiatives that foster long-term relationships, going beyond superficial tactics to address the core reasons why customers leave.

Designing Loyalty Initiatives That Resonate

True customer loyalty isn’t earned with points – it’s earned by consistently providing value. Consider offering exclusive content, early access to new features, or personalized support. These benefits reinforce your subscription’s value and make it indispensable.

For example, a software company could offer premium support to long-term subscribers, providing faster response times and dedicated account managers. This creates a sense of exclusivity and provides tangible value beyond the core software product. You might be interested in: How to master subscription pricing strategies. This personalized approach strengthens the customer relationship and makes competitors less attractive.

Personalizing Engagement Based on Behavior

Generic engagement strategies rarely work. Instead, tailor your approach based on individual usage patterns, customer lifecycle stage, and specific customer segments. This personalized touch shows you understand your subscribers' needs and are invested in their success.

For instance, if a customer isn't using a certain feature, offer targeted tutorials or educational content showcasing its benefits. This proactive approach can re-engage them and highlight the full value of the subscription, preventing churn and strengthening the relationship.

Gathering Actionable Feedback: Listening to Your Subscribers

Actively seek out and analyze customer feedback. This valuable information can highlight areas for improvement and help you address potential pain points before they lead to cancellations. Use surveys, in-app feedback forms, and social media monitoring to gather diverse perspectives.

Think of feedback as your guide, directing you towards a better understanding of your subscribers' needs. This information can help you refine your product or service, improve onboarding, and ultimately, reduce churn by creating something that truly meets customer expectations.

Implementing Success Programs That Drive Feature Adoption

Churn often happens not because of product flaws, but because of underutilization. Creating success programs that guide subscribers towards effective feature adoption is key. These programs might include webinars, tutorials, or personalized onboarding checklists.

For example, imagine a project management software company. By creating a success program that guides users through setting up their first project, collaborating with their team, and generating reports, the company demonstrates the software's full value and boosts user engagement. This turns passive subscribers into active users and fosters a deeper appreciation for the platform.

Creating Community Experiences That Foster Loyalty

Building a community around your subscription creates a powerful network effect. This sense of belonging increases switching costs, making subscribers less likely to leave the product and the social connections they've made.

Online forums, exclusive events, or even a simple Slack group can foster a vibrant community. Sharing success stories, tackling challenges collaboratively, and encouraging peer-to-peer learning strengthens the value proposition far beyond individual features or pricing. This social element makes your subscription more than just a transaction. By combining these value-driven strategies, you can create a subscription experience that goes beyond basic retention and cultivates genuine customer loyalty.

Winning Back Lost Subscribers With Strategic Reactivation

Losing a subscriber doesn't have to be the end of the relationship. Every churned customer presents a valuable second chance. This section explores the strategies behind successful win-back campaigns, turning former subscribers into brand advocates and effectively reducing subscription churn.

Segmentation: Understanding Why Subscribers Leave

Understanding why current subscribers stay is crucial. Equally important is analyzing why former subscribers left. This is the first step to winning them back. Leading subscription businesses segment churned customers based on their cancellation reasons and past behavior. This allows for hyper-targeted win-back offers, addressing specific pain points and demonstrating that you've listened to their concerns.

For example, a customer who canceled due to pricing might be receptive to a limited-time discount. A customer who left due to a lack of a specific feature might be enticed by its recent addition. This segmentation is essential for crafting relevant offers that truly resonate.

Timing Is Key: The Ideal Window for Reactivation

The timing of your win-back campaign is crucial for its success. Reaching out too soon can feel pushy, while waiting too long allows the customer to move on. Research suggests specific time windows are optimal, typically within a few weeks to a month after cancellation. This period gives the customer time to potentially miss your service while their memory of the cancellation reason is still fresh.

This ideal time window can also vary depending on the subscription service. A monthly software subscription might require a quicker reactivation campaign than an annual magazine subscription. Finding the right balance is key to maximizing your win-back efforts. Check out our guide on winning back lost subscribers with strategic reinjection.

The Psychology of Resubscription: Triggering Positive Responses

Winning back subscribers requires understanding their motivations. Appealing to emotions like nostalgia, the fear of missing out (FOMO), or the desire for a simpler solution can be powerful motivators.

Highlighting improvements made since their cancellation or offering exclusive content or features can re-engage their interest. Imagine a software service offering a free trial of a new premium feature specifically to former subscribers. This targeted approach can effectively re-engage churned customers and showcase the increased value.

Balancing Discounts With Enhanced Value: The Win-Back Offer

While discounts can be effective, they should be used strategically. Focusing solely on price can devalue your product. Instead, aim to provide enhanced value propositions. Combine a discount with an upgrade, bonus content, or exclusive access to a new feature.

This strategy reframes the offer as a genuine opportunity for the customer to experience more, increasing the likelihood of sustained engagement and reducing long-term churn.

Measuring and Optimizing Win-Back Efforts: Data-Driven Refinement

Data plays a crucial role in optimizing win-back campaigns. Track key metrics like reactivation rate, customer lifetime value of reactivated subscribers, and the effectiveness of different win-back strategies.

This data-driven approach helps refine messaging, offers, and timing, maximizing your return on investment and building a more resilient subscriber base.

Sharpei's flexible payment solutions can help reduce subscription churn by offering customers more ways to pay. By providing options like rental, lease-to-own, and subscriptions, Sharpei empowers merchants to cater to diverse customer needs, boosting satisfaction and loyalty. Learn more about Sharpei's flexible payment solutions.

Related posts

Ready To Join The Circular Movement?

United for a smarter shopping experience and a better planet