Electronic Lease to Own: Smart Tech Financing

Patricia Bernal

Mar 31, 2025

Navigating the Electronic Lease to Own Landscape

Electronic lease to own (e-lease-to-own) programs provide a different way to acquire electronics. This is especially true for those who might not qualify for traditional financing or prefer not to buy outright. This differs significantly from buying electronics with cash or using financing methods like credit cards. E-lease-to-own gives consumers access to the electronics they want without the hefty upfront cost. Understanding how this alternative financing model works is essential for informed decision-making. This section will explore the specifics of e-lease-to-own arrangements and compare them with other purchasing options.

Understanding the E-Lease-to-Own Agreement

An e-lease-to-own agreement lets consumers use electronics for a set period while making regular payments. Once the lease term ends, the consumer has the option to purchase the item, usually for a nominal fee. This is a key difference from renting, where no ownership transfer takes place. E-lease-to-own programs frequently have more flexible qualification requirements than traditional financing. This can be a significant advantage for people with less-than-perfect credit. These programs provide access to technology while helping individuals build or rebuild their credit history. Many e-lease-to-own agreements also include options to upgrade to newer models during the lease, keeping consumers up-to-date with technology.

Key Differences from Traditional Financing

While e-lease-to-own may appear similar to traditional financing, there are important distinctions. Traditional financing methods, like loans or credit cards, generally involve interest charges. E-lease-to-own programs usually present the difference between the total of lease payments and the original retail price as a "leasing fee" rather than interest. For example, a consumer might lease a laptop for 12 months, making a monthly payment. They then own the laptop after the final payment. The total amount paid will likely be more than the laptop’s original price; this difference is the leasing cost.

The electronic lease-to-own market is a subset of the broader rent-to-own industry. This industry has experienced significant growth in recent years. As of 2024, the global rent-to-own market is valued at roughly USD 93.514 billion. It's projected to grow at a compound annual growth rate (CAGR) of 5% between 2024 and 2031. Learn more about this growing market here. This growth is fueled by demand for flexible financial options, especially for consumers who may have difficulty accessing traditional credit. Electronics and appliances are a core part of this market, allowing consumers to acquire necessary items without needing to pay the full price immediately. Another crucial difference is ownership. With traditional financing, the consumer owns the item from the outset. With e-lease-to-own, ownership transfers only after all payments are made. Until the final payment, the leasing company retains ownership of the electronics.

Product Suitability for E-Lease-to-Own

E-lease-to-own isn't ideal for every type of electronic product. Generally, products with shorter lifespans or those that quickly become outdated, like smartphones or laptops, are frequently offered through these programs. Consumers can benefit from upgrade options as technology advances, allowing them to use the latest models. Items with longer lifespans and slower rates of depreciation, such as televisions or major appliances, may be better suited for traditional purchases. The best way to acquire a specific product depends on the item and the individual's financial situation. Consumers should carefully consider the costs and benefits of each option before entering into an agreement.

Why Electronic Lease to Own Programs Are Gaining Traction

Electronic lease to own programs are changing how consumers acquire technology. They offer a compelling alternative to traditional financing or buying outright. This is particularly appealing for those wanting to keep up with the latest tech advancements. Imagine always having the newest smartphone without the hefty upfront cost. This is the core appeal of electronic lease to own: manageable access to cutting-edge technology.

Appealing to Tech Enthusiasts

These agreements cater to the fast-paced electronics industry. They offer built-in flexibility for tech enthusiasts, making constant upgrades a real possibility. This contrasts sharply with traditional purchases, where consumers often find themselves stuck with outdated devices.

Many programs also include maintenance and service benefits. These protect against unexpected repair costs and malfunctions, adding considerable value for consumers. You might be interested in our guide on the benefits of lease to own programs.

Financial Flexibility and Accessibility

Electronic lease to own programs offer financial solutions for various situations. They accommodate financial fluctuations and often have less stringent qualification requirements. This opens up options for people who might not qualify for traditional loans.

The rent-to-own market, including electronics, has experienced significant growth in the United States. It reached USD 12.31 billion in 2023 and is projected to hit USD 19.39 billion by 2031. This represents a CAGR of 6.77%. You can find more detailed statistics here.

This growth is fueled by tighter lending standards and increased demand for flexible financing. Trends like rising urbanization and increased e-commerce activity for rent-to-own services further contribute to this expansion. This data suggests that many are turning to this option to access needed technology.

Building Credit and Ownership Pathways

Electronic lease to own agreements create a path towards ownership, unlike traditional rentals. This is a major advantage for those looking to build credit. By making consistent, on-time payments, consumers demonstrate financial responsibility, positively impacting their credit scores over time.

Rather than a last resort, savvy consumers view these agreements strategically. They see them as a way to acquire technology and simultaneously improve their financial health. These combined benefits contribute to the growing popularity of electronic lease to own. They represent a practical, accessible method for consumers to keep pace with technological advancements.

To better illustrate the differences between lease to own and other purchase options, let's examine a comparison table.

This table compares key features of electronic lease to own programs with traditional credit options and outright purchases:

Feature | Electronic Lease to Own | Credit Card Purchase | Store Financing | Cash Purchase |

|---|---|---|---|---|

Initial Payment | Low | Varies (potentially high depending on credit limit) | Varies (often requires a down payment) | High (full price) |

Ownership | Acquired after lease term | Immediate | Immediate | Immediate |

Credit Impact | Can build credit with on-time payments | Impacts credit utilization and payment history | Impacts credit score and may require a hard inquiry | No impact |

Flexibility | Option to upgrade or return at end of lease term | Dependent on credit limit and card terms | Fixed payment schedule, less flexible | No ongoing payments |

Total Cost | Generally higher than cash purchase | Dependent on interest rate and repayment period | Dependent on interest rate and financing terms | Lowest overall cost |

In summary, the table highlights the trade-offs between different purchasing methods. While lease to own offers accessibility and flexibility, it typically results in a higher overall cost compared to a cash purchase. However, its credit-building potential and upgrade options make it attractive for certain consumers.

How Digital Innovation Is Transforming Lease to Own

The lease-to-own industry is changing. Where once cumbersome paper processes were the norm, digital advancements are rapidly modernizing how consumers acquire electronics. This shift is making the entire experience, from initial browsing to ongoing account management, significantly more efficient.

Mobile Apps and Seamless Experiences

Leading lease-to-own providers are now offering mobile apps. These apps empower consumers to browse products, manage payment schedules, and track their account status directly from their smartphones. This provides unprecedented accessibility and control.

For example, many apps offer payment reminders. This helps consumers avoid late fees and maintain a positive payment history. These apps also act as a central communication hub between the consumer and the provider.

AI-Powered Approvals and Faster Access

Artificial Intelligence (AI) is also playing a key role in reshaping the lease-to-own landscape. AI-powered approval systems drastically reduce application processing times. Consumers can get the electronics they need faster than ever before.

Furthermore, AI can help expand access to these programs for individuals who might not qualify through traditional lending channels. This inclusivity broadens the market and allows more people to benefit from lease-to-own options.

E-Commerce Integration and Expanding Reach

The lease-to-own market is increasingly integrating with e-commerce platforms. In 2021, e-commerce represented roughly 41% of the U.S. rent-to-own market. This segment is projected to grow at a 10.08% Compound Annual Growth Rate (CAGR). For a deeper dive into these statistics, check out this report: US Rent-to-Own Market Report.

This growth is driven by increased internet access and a growing consumer preference for digital transactions. E-commerce platforms also expand market reach and allow providers to offer more personalized services. For further reading on the future of electronics rentals, see this article: Electronics Rental: The Smart Choice for Businesses and Consumers in 2025. This digital shift creates significant opportunities for industry growth and innovation.

Emerging Technologies and the Future of Leasing

The electronic lease-to-own industry is constantly evolving. Looking beyond current advancements, emerging technologies promise to reshape the customer experience further. Blockchain technology, for example, could enhance security and transparency in lease agreements, potentially allowing for secure storage and easy verification of contracts.

Virtual and Augmented Reality also hold promise for the industry. These technologies could offer customers interactive product demonstrations, allowing them to experience electronics before committing to a lease. These and other innovations point to an exciting future for the lease-to-own industry, with a focus on accessibility, convenience, and security.

The Real Cost Equation of Electronic Lease to Own

Electronic lease to own offers convenience and accessibility. For many, it's a tempting way to acquire the latest electronics without the upfront cost. However, it's essential to understand the full financial implications before signing on the dotted line. This means looking beyond the attractive payment plans and understanding the true long-term cost.

Decoding the Lease-to-Own Price

Electronic lease to own programs allow you to obtain electronics without a significant initial investment. This accessibility comes at a price, though. Essentially, you're paying a premium for the flexibility of the program. This often translates to paying more than the retail price over the lease term.

Think of it like a long-term rental. You’re paying for the use of the item, not outright ownership. Just like renting a car, the total cost over time can significantly exceed the vehicle's sticker price. This is a crucial factor to consider when evaluating lease-to-own options.

Hidden Costs and Total Expenditures

One key area requiring careful scrutiny is the difference between the total lease cost and the item's retail price. This difference represents the actual cost of the lease-to-own agreement. Beyond the advertised payments, be aware of potential hidden fees.

These can include processing fees, late payment penalties, and other charges that can quickly accumulate. A small weekly payment might seem manageable, but the cumulative effect of these added fees over the lease term can result in a significantly higher overall cost compared to a standard monthly payment.

Early Purchase Options and Potential Savings

Many electronic lease to own programs offer an early purchase option. This allows you to buy the item outright before the lease term ends, often at a discounted price. While this sounds appealing, it's crucial to do the math.

Carefully calculate whether exercising the early purchase option truly offers savings compared to buying the item upfront or through traditional financing. Consider the total amount paid up to the point of early purchase and compare it with other purchasing options.

Industry Scrutiny and Potential Pitfalls

Despite its market growth, the electronic lease-to-own industry is facing increased scrutiny. Rent-to-own agreements can lead to consumers paying substantially more than an item’s retail price, with effective interest rates sometimes exceeding 60%. This has raised concerns about potentially predatory lending practices, leading some states to consider stricter regulations for rent-to-own stores. Furthermore, the rapid depreciation of electronics means that by the time the lease ends, the item may be technologically outdated. For more information on leasing, see Renting Issues in Business and Their Solutions - Advantages of Leasing.

To better illustrate the cost differences, let's look at a comparison:

Cost Comparison: Lease vs. Purchase

This table shows the total cost difference between electronic lease-to-own arrangements and direct purchases for popular electronic items.

Electronic Item | Retail Price | Lease Payment | Term Length | Total Lease Cost | Additional Cost % |

|---|---|---|---|---|---|

Smartphone | $1000 | $50/week | 1 year | $2600 | 160% |

Laptop | $1500 | $75/week | 1 year | $3900 | 160% |

TV | $500 | $25/week | 1 year | $1300 | 160% |

As this table demonstrates, the total cost of leasing can be significantly higher than the retail price. This highlights the importance of carefully evaluating all options before entering a lease-to-own agreement.

Negotiating Favorable Terms

While lease terms are often presented as fixed, there may be room for negotiation. Don’t hesitate to ask about potential discounts, waived fees, or a lower overall cost. A customer with a good payment history might be able to negotiate a reduced leasing fee.

Being proactive in negotiations can significantly impact the final cost of the agreement. Even small concessions can add up to substantial savings over the lease term.

Evaluating Lease Agreements

Before signing any electronic lease to own agreement, ask clarifying questions. Understand all the terms and conditions, including payment schedules, fees, and early purchase options. Compare offers from different providers to ensure you’re getting the best deal.

By understanding the real cost equation of electronic lease to own, you can make well-informed decisions that align with your financial goals and technological needs. Don’t let the allure of instant gratification overshadow the long-term financial implications.

Future-Focused Trends Reshaping Electronic Lease to Own

The electronic lease-to-own market is experiencing a period of rapid transformation. Consumer expectations and technological advancements are creating a dynamic environment, particularly with younger generations leading the charge. Let's delve into the key trends shaping the future of this industry.

Younger Consumers and Shifting Preferences

Younger consumers are increasingly drawn to the sharing economy, influencing their views on ownership and making lease-to-own options more appealing. They prioritize access over traditional ownership models.

This shift creates demand for flexible lease-to-own programs. These consumers seek options that align with their lifestyles and financial situations.

Comfortable with subscription services, they look for similar flexibility in lease-to-own agreements. This preference is reshaping how companies structure their offerings.

Sustainability and Refurbishment Programs

With growing environmental awareness, sustainability is becoming a core business principle. Forward-thinking electronic lease-to-own providers are incorporating these values into their operations.

One key aspect of this is offering refurbished electronics. This provides a cost-effective and environmentally conscious choice for consumers.

These programs often incorporate responsible recycling practices, further reducing environmental impact. This approach resonates with consumers looking to minimize their ecological footprint.

AI-Powered Personalization and Payment Flexibility

Artificial intelligence (AI) is revolutionizing the customer experience through personalization. AI can tailor payment plans to individual financial patterns.

This offers greater flexibility and simplifies payment management. AI's impact extends beyond payment schedules.

It can also generate personalized product recommendations, improve browsing experiences, and streamline the application process. This creates a more user-friendly and efficient experience.

Market Dynamics and Emerging Challenges

The electronic lease-to-own market is influenced by broader economic factors. Rising GDP growth, increasing disposable income, and a growing millennial population all contribute to market expansion.

Technological advancements and new product categories, such as smartphones, continue to drive demand. More detailed statistics can be found here.

However, challenges remain. Security concerns and vendor dependencies are significant hurdles the industry must address to ensure continued growth and stability.

Expanded Product Catalogs and Market Evolution

The electronic lease-to-own sector is broadening its horizons beyond traditional electronics, marking a significant market shift.

An increasing number of non-traditional electronics are being offered through these programs, reflecting a growing consumer desire for flexible acquisition models.

This expanding product catalog will likely continue to evolve alongside changing consumer preferences and market conditions. This adaptability underscores the growth potential within the electronic lease-to-own industry.

Mastering Electronic Lease to Own: Insider Strategies

Navigating the electronic lease-to-own world requires a proactive approach. Consumers benefit most when they compare providers, understand agreements, and manage payments effectively.

Comparing Providers: Beyond the Advertised Rate

Shopping around is the first step. Different providers offer varying terms, and the most advertised deal isn't always the best. Focus on the total cost, not just the weekly or monthly payment.

Factor in all fees: Ask about processing, delivery, and other potential costs. Some providers have lower weekly payments but higher overall fees.

Compare lease durations: Shorter terms mean higher payments but a lower total cost. Longer terms might be more manageable monthly but could cost significantly more over time.

Research the provider: Check online reviews on sites like Trustpilot for complaints about hidden fees or deceptive practices.

Inspecting and Understanding Agreements

Before signing, thoroughly inspect the item and read the fine print. This prevents future problems.

Pre-lease inspection: Examine the electronics for existing damage. Document any defects to avoid later responsibility.

Decode the fine print: Pay attention to clauses about late fees, early purchase options, and damage liability. Ask for clarification if anything is unclear.

Negotiate terms: Don't be afraid to negotiate a lower price, waived fees, or a better payment schedule.

Managing Payments and Leveraging History

Strategic payment management maximizes savings and builds a positive payment history.

Set up payment reminders: Avoid late fees with automated payments or reminders. Consistent on-time payments can improve future negotiation power.

Explore early purchase options: If your finances improve, consider an early purchase. Calculate if it truly saves money compared to completing the lease.

Leverage payment history: A strong record can be an asset. Use it to negotiate future lease terms or qualify for traditional financing.

Resolving Service Issues Effectively

Issues with leased electronics are inevitable. Having a plan is key.

Document everything: Record all communication with the provider, including dates, times, and names.

Understand your rights: Familiarize yourself with the warranty and service agreement. Know what's covered and for how long.

Escalate issues: If unresolved, escalate to a supervisor or manager. Be persistent but polite.

Identifying Warning Signs and Problematic Agreements

Awareness of red flags helps avoid problematic agreements.

Excessively high fees: If the total cost is dramatically higher than the retail price, look elsewhere.

Unclear terms and conditions: Avoid vague or confusing language. Transparency is essential.

Pressure tactics: Reputable providers won't pressure you. Take your time to decide.

By following these strategies, consumers can navigate electronic lease-to-own effectively, making informed choices and maximizing benefits while minimizing risks.

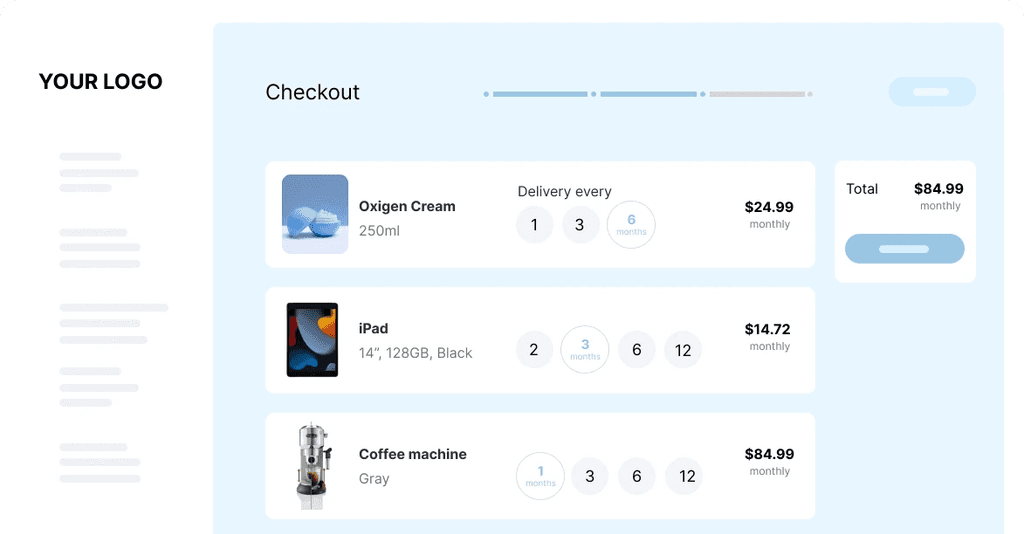

Ready to explore flexible payment options for your business? Sharpei offers innovative solutions for merchants looking to provide rental, lease-to-own, and subscription models at checkout. Learn how Sharpei can help you increase conversions and boost sales at https://www.gosharpei.com.

Related posts

Ready To Join The Circular Movement?

United for a smarter shopping experience and a better planet